At this moment life without digital payment is really very difficult, in 2015 I would don’t even heard about UPI or digital payment. then how suddenly, it came in so trending?

8, Nov 2016 was the date when demonetization occurred in India, from that day the digital payments industry rise story, began

Because of the demonetization, people were suffered from a lack of available cash, most of the attention of people was shifted towards digital payment apps and this thing benefited the digital industries.

Gradually, people’s trust grew and people got involved with the digital payment industry, and this industry is booming today.

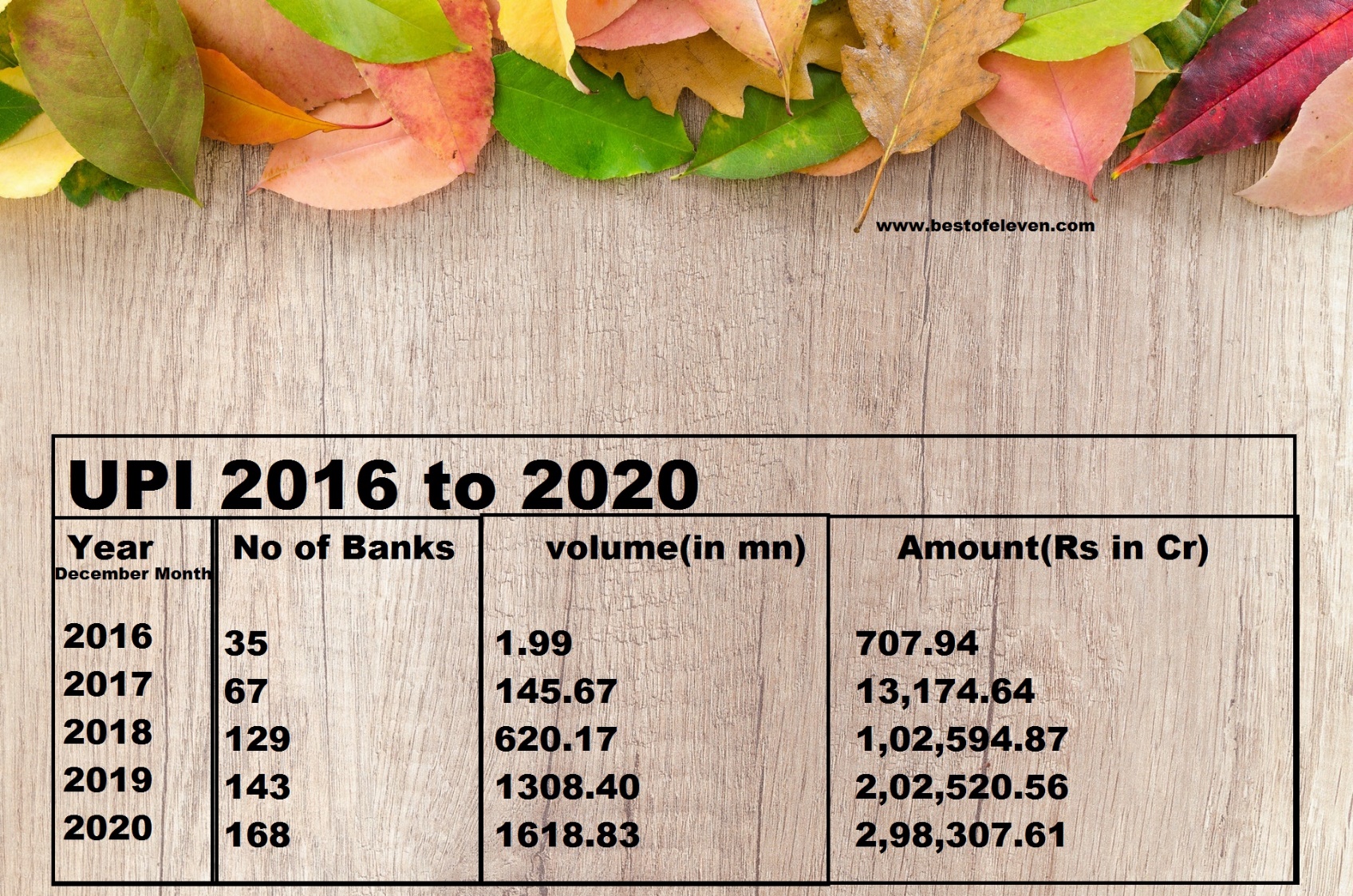

In that time the total amount of UPI industry was only 3 crores, can you believe this and now the total amount of UPI Industry are around 298307 crores, maybe it’s a 1 lakh times of the previous amount

You can also get clear info from this pic also-

Today in 2020 you will get many apps, but the best apps of digital payment, which are considered the best, will compare them today.

Simply without any delay, they are Phonepe, Google pay, and Paytm

- First of all, we see their initial phase and then compare them all together(phonepe or google pay or Paytm).

Phonepe-

Sameer Nigam is the person who created “Phonepe” in December 2015, with his colleague Rahul Chari and Burzin Engineer.

The Phonepe app, based on UPI “Unified Payments Interface”, went live in August 2016.

Headquarter of Phonepe –Bengaluru

In April 2016, Phonepe is obtained by Flipkart, and also in August 2016, The company partnered with Yes Bank to launch a UPI based mobile payment app.

By using Phonepe, Users can send money, Receive Money, Recharge (Mobile, DTH, Data cards, and many more) make utility payments, liquids funds, and many more.

Phonepe accepted as a payment option at over 10 million consignors and also crossed 5 billion transactions in Dec 2019.

When the app is launched in the Google Play store, within 3 months of this app, achieve 10 million downloaded.

it also emerged as India’s first 50 million payment app in the Google play store.

Phonepe is also available in 11 Indian language

English, Hindi, Telugu, Tamil, Kannada, Malayalam, Marathi, Bengali, Gujarati, Odia, Punjabi.

Paytm-

Vijay Shekhar Sharma is the man who created the “Paytm app” in 2010 in Noida. In their early phase, they only did prepaid mobile recharge and DTH recharge.

In 2013 they added data cards, postpaid recharge, and landline payments also.

By January 2014 Company also launched the Paytm wallet. In 2011, Sapphire Venture invested 10 million.

Funding and Shareholding=

|

SHAREHOLDERS |

SHAREHOLDING |

|

Vijay Shekhar Sharma |

14.67% |

|

Ant Financials |

29.71% |

|

Softbank Vision Fund |

19.63% |

|

SAIF partners |

18.56% |

|

AGH |

7.18% |

|

Berkshire Hathway |

2.76% |

|

Others |

7.49% |

|

Total |

100.00% |

In 2017, Paytm is the first payment app in India crossed 100 million downloads, By using Paytm, Users can send money, Receive Money, Recharge (Mobile, DTH, Data cards, and many more) make utility payments, booking flights, train, buses and many more, same as Phonepe.

Paytm is also available in 11 different languages –English, Hindi, Tamil, Telugu, Gujarati, Marathi, Bengali, Kannada, Malayalam, Oriya, and Punjabi.

You can send and receive Money, Pay in stores and websites

Google pay-

It is originally launched as Android pay in the year 2015 by Google. Android Pay was a descendant to and built on the base established by Google Wallet which was released in 2011. Google launched Tez in India on 18, September 2017, and on 28, August 2018 “Tez” was renamed to Google Pay. It was an instant hit among the Indian public with 8.5 million downloading, within a record time of 40 days, 30M transactions were performed.

Google pay available in 8 Indian languages – English, Hindi, Bengali, Kannada, Gujarati, Marathi, Tamil or Telugu

Currently Google pay available in 30 Countries across the world. You can use Google pay for sending and receiving money directly in your bank account, recharge on mobile, DTH, and many more.

Similarities between Phonepe, Paytm, And Google pay-

-

You can link your one Bank account on it.

-

You can check your Bank balance anytime, anywhere.

-

You can Send and Receive Money instantly

-

They all give a few Cashbacks or offers after using their apps for Transactions.

-

You can recharge your mobile ( Prepaid or Postpaid)

-

Zero Banking Charge

Now, Comparing phonepe or google pay or Paytm dissimilarities

-

Modes of Payments-

Phonepe– Mostly users used Phonepe as UPI payments

Paytm– Paytm is used as multiple modes like UPI, wallets, and payment gateway

Google pay-Google Pay is used only for UPI payments

-

Online shopping-

Phonepe-It puts all other online stores and shops on its own platform to bring everything in one place

Paytm– Paytm has it’s own Mall and shops

Google pay-Same as Phonepe it also puts other stores within its platforms.

-

Wallets-

Phonepe-In Phonepe wallet you cannot keep or spend more than Rs. 10,000 within a month

Paytm- You cannot keep or spend more than Rs. 10,000 in your Paytm wallet in a month. To upgrade your limit to Rs. 1 Lakh, please get your account verified with us using the KYC process.

Google pay- doesn’t available wallet in India now.

-

Transfer money from wallets charges-

Phonepe- You can easily transfer money to your account without any charge.

Paytm-There is a 5% Charge for transferring from wallet to Bank account.

Google Pay-Wallet is not available.

-

Booking and Registration-

Phonepe-Phonepe has a deal with other travel agencies and companies to integrated to his own platform

Paytm-The Flight, train, or bus ticket booking can be done from the in-house Paytm travel section.

Google Pay-It is also integrated with other travel booking apps to its platform to bring everything in one roof.

-

Transaction-

Phonepe-Maximum Bank Account transaction = Up to Rs 1,00,000 per month

Paytm-You can Maximum transaction of Rs 25,000 per month and if you are fully have done KYC in Paytm then your transaction will be up to Rs 1,00,000 per month.

Google pay– Maximum Bank account transacation= Rs 1,00,000

-

Special features-

Phonepe- Because of their deals with many Companies, you have high chances to get extra discounts on your orders or booking.

Paytm-Paytm has its own bank, which is giving a great interest rate.

Google pay– You can send and receive money to nearby Google pay users without having each other phone numbers, this can be done by toggling the Tez mode switch.

-

Users in India monthly

Phonepe-55 million

Paytm-140 million

Google pay-55 million

-

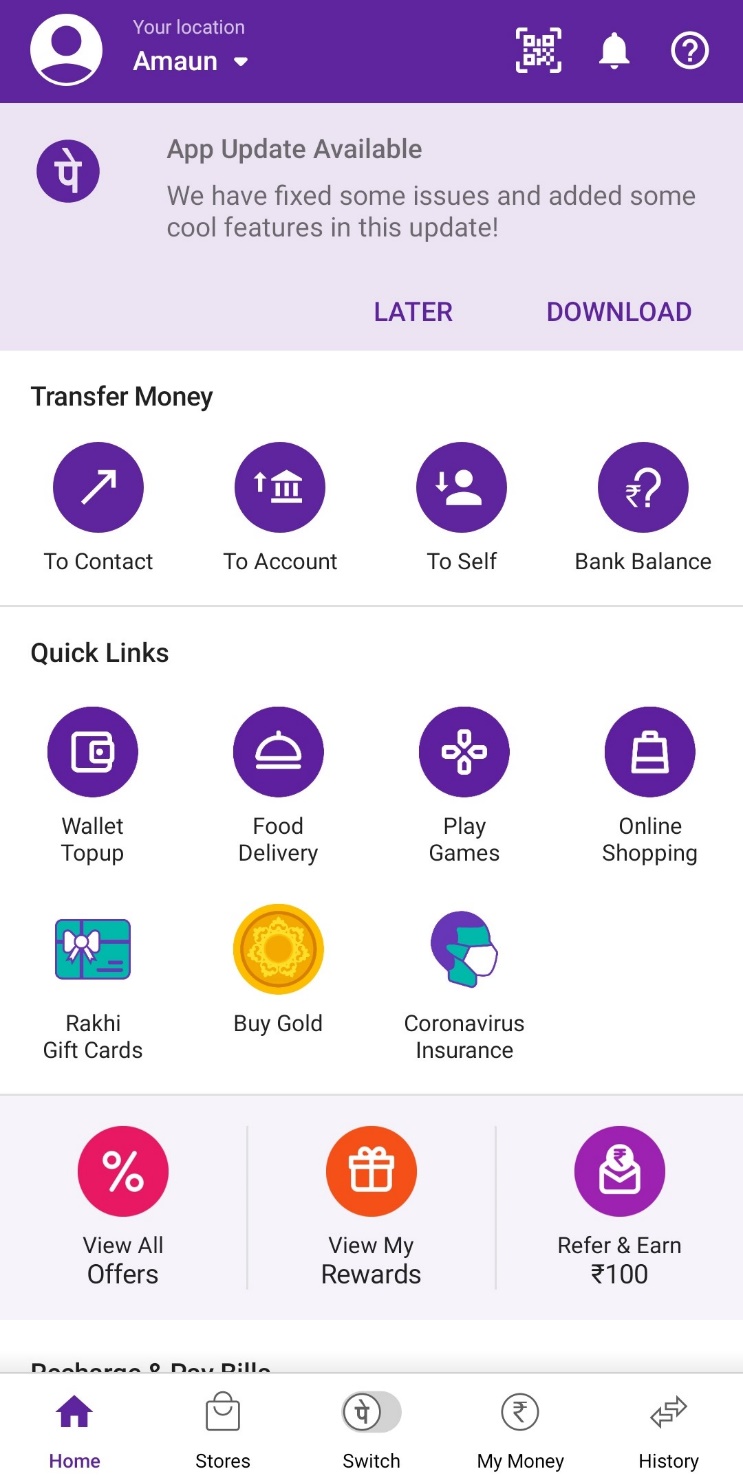

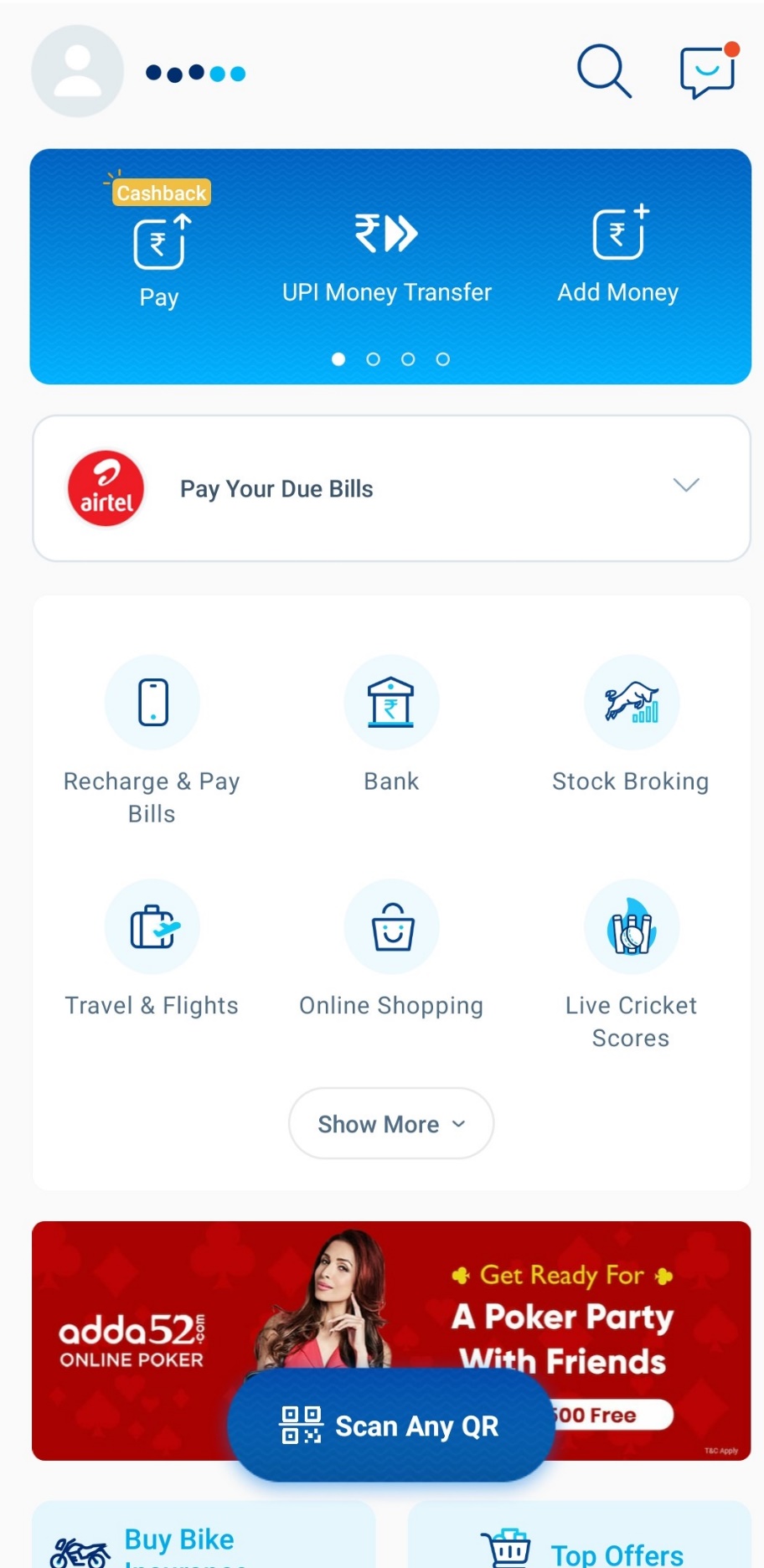

Interface

Phonepe-

Paytm-

Google pay-

Now all the comparisons between them are complete, so it’s time to announce the winner name-

- If you want digital payment only for the transaction then go for Google pay. It is best of all, and second, you can go for Phonepe

- If you Love a simple interface then Google pay is perfect there is no messy of icons

- Want E-wallet also then Paytm is perfect for you.

- If you are using your app for travel and flight booking then I especially recommending you go for Paytm,it is so easy and comfortable and in a second you can choose Phonepe

- For ordering Foods and Items – Phonepe is best because of many coupons and discounts available on its.

- Best security-They all are good in terms of security but if you want the best of best then go for Google Pay because Of the Parent company of Google pay is Google so in terms of security, it is far ahead.

- Recharge phone, DTH, and others- Then go for anyone they all are good and fast, and you also get a chance to win cashback in all.